【Financial Investment】《Rich Dad Poor Dad》author Robert Kiyosaki ever went bankrupt? The truth is. . .

《Rich Dad Poor Dad》 sold more than 30 million copies worldwide, but the best success tutor Robert Kiyosaki declared bankruptcy in 2012, and fans were taught another vivid lesson…

How popular is the book 《Rich Dad Poor Dad》? Topped《The New York Times》 bestseller list for six consecutive years. Oprah has recommended his book. Will Smith is also a fan. The 《Rich Dad Series》 books have sold 36 million in 109 countries around the world. Besides《Bible》 and 《Jobs Biography》 in the Western world, there are none other books that can sell like this.

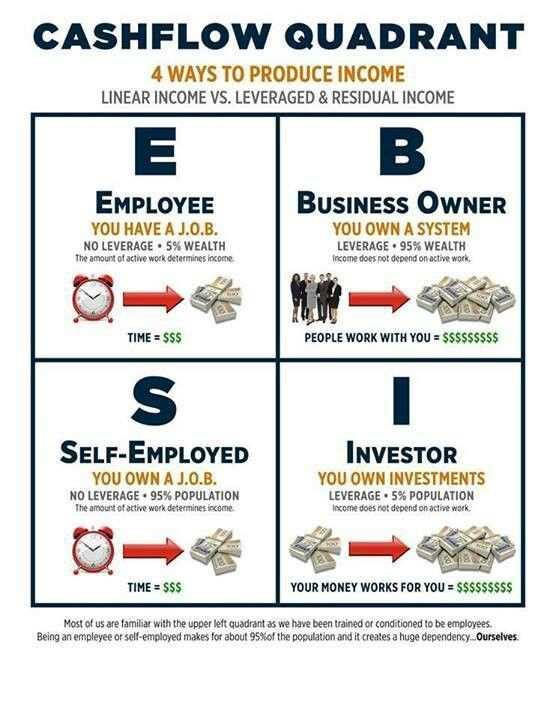

I believe everyone will think of the ESBI categories when they hear about 《 Rich Dad Poor Dad》and his most famous book teach about everyone must get rid of the trap of the mouse race and get into B and I categories.

The author of 《Rich Dad Poor Dad》Robert Kiyosaki is a Japanese-American. The general content of the book is: Robert Kiyosaki’s father (poor dad) is a well educated but relatively poor person, and the father of Robert Kiyosaki’s friend (rich dad). He is a businessman who doesn’t have high education level. The book records the different encounters of the two fathers and their different teaching methods and influences on Robert Kiyosaki. Overall, the poor dad focused on telling Robert Kiyosaki to study hard and work hard; the rich dad encouraged Robert Kiyosaki to start a business and own the assets.

《Rich Dad Poor Dad》has two particularly classic sayings: “The rich buy assets, the poor only spend, and the middle class buys liabilities that they think are assets.’’and “Any legal asset you own, you can consider finding out the more benefits and protections you can enjoy when you have the same assets in the form of a business.” The first sentence shows the common traps of the middle class, and the latter sentence is full of wisdom and mystery.

Robert Kiyosaki, the author of 《Rich Dad and Poor Dad》 ever broke?

The author himself, Robert Kiyosaki did not go bankrupt , but one of the companies went bankrupt , and he still has 10 companies and 7,000 properties under his name (the properties are under his wife’s name). This is Robert Kiyosaki’s 2018 estimated assets status, estimated net assets of 80 million US dollars . Robert Kiyosaki has financial freedom and retired before he published 《Rich Dad and Poor Dad》.

At his peak, he owned 11 companies. Most of these companies are financial consulting agencies and companies. The most common business is to offer various investment and financial management courses, and the company’s performance has been good. So, how did bankruptcy come about? In 2012, the author Kiyosaki’s “Rich Global LLC’’ went bankrupt. What’s happening here?

The general situation is: Robert Kiyosaki’s “Rich Global LLC’’ cooperates with a company called Learning Annex , borrowing the resources and platform of the other party to spread the course. After the course was finished, perhaps because of the unfairness of the internal agreement, the dispute was caused. Robert Kiyosaki’s company did not pay the other party a penny, and the other company went to court. In the end, the court sentenced Robert Kiyosaki’s “Rich Global LLC’’ to compensate the other party with USD 23 million. . “Rich Global LLC’’ is the most well-known company under Robert Kiyosaki’s name, but its actual value is only 4 million US dollars . Under consideration, Robert Kiyosaki let the company go bankrupt .

It’s just company bankruptcy, not personal bankruptcy. The CEO of “Rich Global LLC’’, Mike Sullivan claimed that the bankruptcy settlement of the company will not involve any personal assets of Kiyosaki.

Previously, Robert Kiyosaki’s net assets were valued at US$80 million by foreign estimation websites. According to Sullivan, these assets will not be affected during the liquidation process. Robert Kiyosaki is still in the ranks of “rich dad”. This story verifies the advice in the previous book 《Rich Dad and Poor Dad》: “ Any legal asset you have, you can consider finding out more benefits and protections that you can enjoy when you own the same assets as a business. ’’

Everyone thinks that Robert Kiyosaki only advocates investment in real estate, in fact. . .

What is the author of 《Rich Dad Poor Dad》 Robert Kiyosaki doing recently and what projects he advocates to invest in?

The author of 《Rich Dad Poor Dad》, Robert Kiyosaki has published the books and taught the students about investment and financial quotient in recent years. The book 《FAKE: Fake Money, Fake Teachers, Fake Assets》 published in the recent years of 2019 revealed some sensitive but practical issues and news.

Robert Kiyosaki, with all his strength, kept shouting “Fake, Fake, Fake, Fake” , as a warning, must learn financial quotient,be careful that all your money is stolen!

After the U.S. ended dollar convertibility to gold and implemented wage and price controls in 1971, the U.S. dollar was no longer real money. The United States turns on the money printing machine and desperately prints money. Paper money enters the channel of accelerated devaluation, and your wealth is constantly being stolen.

You can only have wisdom of financial management and discern what is the real asset by learning the knowledge of financial quotient.

Being rich now does not mean that you are rich. The reason why rich people are rich is because they understand the nature of money and know how to buy real assets at the right time.

Robert Kiyosaki, the author of 《Rich Dad Poor Dad》predicts that from 2022 to 2025 (Covid-19 will be an accelerator of the economic turmoil), the United States will once again break out a more serious economic crisis, this time cause the US pension deficit. This economic tsunami will affect every corner of the world.

What should we do in this change?

First, we must learn and find good teachers, not fake teachers. Learn from people who have results, learn from masters.

Second, purchase assets that are value-preserving. For example, gold is God’s money, the indelible money God bestows on mankind, and it is real money.

Why accumulate assets? Assets can bring you income when you are not working.

Whether a person has the financial literacy, the rich mindset and ability is the key to driving the rich and the poor.

Instead of spending the money for drinking milk tea, smoking, drinking or entertainment, use the money wisely for investment. Will your life be the same in the future?

Learning is an investment that never depreciates.

Follow a reliable investment education system,learn financial knowledge, diversify risks, increase asset income, be a rational investor, rather than a speculative retail investor.

Like and Follow Facebook Page: Work Your Wealth International Investment Coach

It’s time to grasp the pulse of this rapidly changing era, make the right choice at the critical moment, and get faster progress and a better life.

©All rights reserved.

喜欢我的作品吗?别忘了给予支持与赞赏,让我知道在创作的路上有你陪伴,一起延续这份热忱!

- 来自作者

- 相关推荐