【Financial Investment】Central Bank Digital Currency Global finance New ‘Battlefield’

Why is China striving for digital currency dominance?Mastercard Launches Digital Currency Testing Platform for Central Banks

China is advancing large-scale digital currency testing, and many countries around the world are competing fiercely.

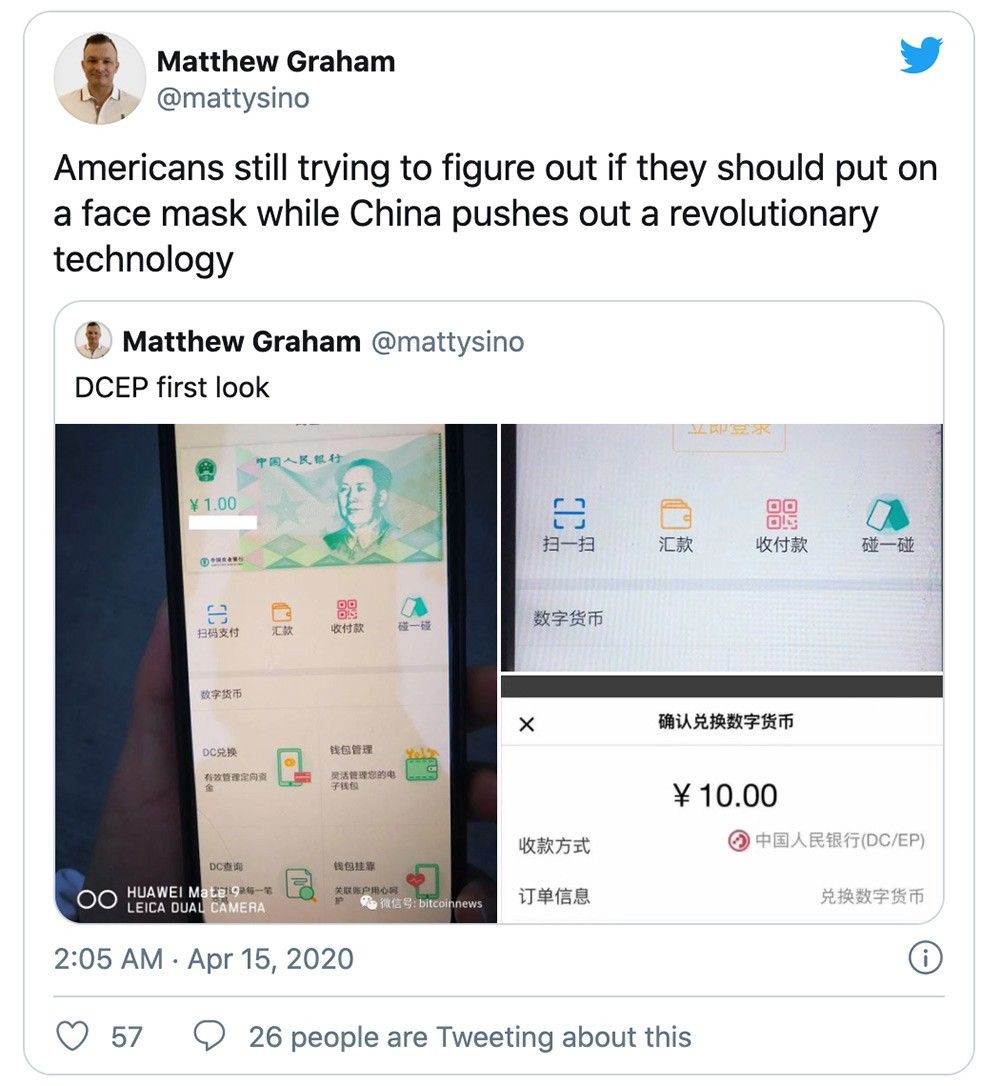

China’s four major state-run commercial banks are reported to have started large-scale internal testing of a digital wallet app, moving a step closer to the official launch of the world’s first sovereign digital currency.

Bank of China, China Construction Bank, Industrial and Commercial Bank of China, and Agricultural Bank of China are piloting the digital RenMinBi with the central bank in major cities, including Shenzhen.

In terms of developing a national digital currency, China has developed faster than any country.This pure digital RenMinBi is developed based on blockchain technology, and the blockchain is a database of records for cryptocurrencies such as Bitcoin.

In October 2019,Chinese President Xi Jinping has appealed for greater urgency in the development of blockchain technology in a move analysts say could open up a new front in the country’s growing rivalry with the United States.Blockchain would play “an important role in the next round of technological innovation and industrial transformation”, Xinhua quoted him as saying at a group study session for members of the Politburo.

General Secretary Xi demonstrated his strong support for blockchain in a speech and became the first major world leader to support this technology. He expressed that he would “seize the opportunity” and hope that China “occupies a leading position” in this field.

China has formulated a plan to issue legal digital currency by the central bank many years ago.

In 2016, Zhou Xiaochuan, then governor of the People’s Bank of China, said that he planned to use digital currency to replace banknotes that have been in the country’s history for more than 800 years in about ten years.

The full name of this future currency is a bit lengthy. It is called “digital currency/electronic payment” (DC/EP, hereinafter referred to as digital currency), but this is an exciting step in the digital direction. The Chinese government aims to prepare the currency, which is currently in the closed beta stage, to achieve wider applications by the time Beijing hosts the Winter Olympics in February 2022 — allowing China to demonstrate its financial technology capabilities on the global stage.

China has begun to test digital renminbi since May. Civil servants in Suzhou have received 50% of the transportation subsidy in the form of digital currency. Shenzhen, Chengdu and Xiong’an New District near Beijing are also conducting similar tests related to local merchants. . While most countries are still distracted by the Covid-19,China is not only more economically robust than they allow, it is also putting itself through a quiet — and welcome — financial revolution.

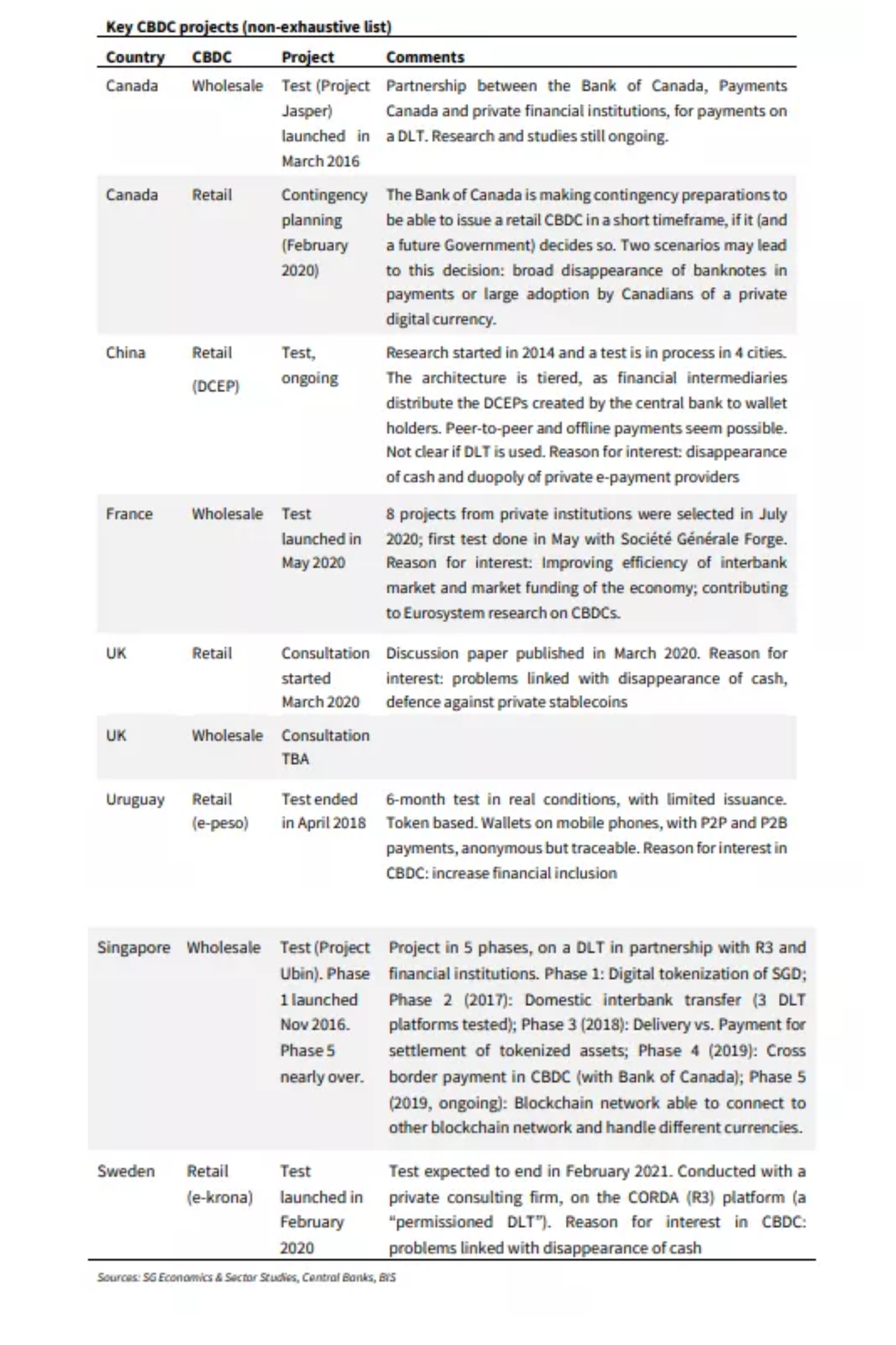

With the gradual exposure of Libra and China to the development of central bank digital currencies, the global central bank digital currencies began to heat up, sooner or later, other countries have also poured into this track. Despite the economic contraction caused by the Covid-19, the global competition for digital currencies continues.

Central bank digital currency is the digital form of fiat money.The present concept of CBDCs was directly inspired by Bitcoin, but CBDC is different from virtual currency and cryptocurrency.Central bank digital currency is issued by the state and the legal tender status declared by the government.

In July 2020, Lithuania, an EU country, became the world’s first central bank to issue digital currencies. Other countries have also set up plans to issue central bank digital currencies. The following are only incomplete statistics on the progress of CBDC in various countries around the world. According to the survey results released by the National Settlement Bank in 2020, 10% of central banks consider issuing digital currencies in the short term. The economies of these central banks cover 20% of the world’s population. (About 1.6 billion people).

As the global economy accelerates to embrace digital payments, central banks of various countries have also focused on the future and promoted digital currency research and development, hoping to maintain the stability of monetary policy and financial system while supporting innovation and development.

On September 10, 2020, MasterCard announced a proprietary virtual testing environment for central banks to evaluate CBDC use cases. The platform enables the simulation of issuance, distribution and exchange of CBDCs between banks, financial service providers and consumers. Central banks, commercial banks, and tech and advisory firms are invited to partner with Mastercard to assess CBDC tech designs, validate use cases and evaluate interoperability with existing payment rails available for consumers and businesses today.

Mastercard is a leader in operating multiple payment rails and convening partners to ensure a level playing field for everyone — from banks to businesses to mobile network operators — in order to bring the most people possible into the digital economy. Mastercard wants to harness its expertise to enable the practical, safe and secure development of digital currencies.

With the global economy racing to embrace digital payments, central banks also are looking to the future and investigating how to support innovation while maintaining monetary policy and financial stability as they issue and distribute currency. In fact, 80 percent of central banks surveyed are engaging in some form of Central Bank Digital Currencies (CBDCs) work, and about 40 percent of central banks have progressed from conceptual research to experimenting with concept and design, according to a recent survey by the Bank for International Settlements.

Even if the digital currency fails to shake the U.S. dollar’s global reserve status, it may cause trouble to the United States.

China is seizing the opportunity to become an indispensable part of the world’s digital map in the coming decades.

Beijing-based Red Date Technology is a company supported by the Chinese state and is committed to providing blockchain-based cloud services. The company’s chief executive, Yifan He, likened all work to “building the next Internet.” Of course, the current Internet is due to research funded by the Pentagon. This is a reminder that a government with ambitions for technology can reshape economic history in a profound way.

https://twitter.com/i/status/1297640002604527621

In July 2019, the IMF issued a report called “The Rise of Digital Money”, which warned that if digital currencies or those cryptocurrencies linked to fiat currencies become more widely used, cash And the bank deposit system may be eliminated:

“(Cash and the banking system) will face fierce competition and may even be surpassed by these new forms of value transfer.”

As early as November 2018, at a financial technology conference in Singapore, Christine Lagarde, the then IMF chairman, stated that “encourage central banks to explore digital currencies” :

Money itself is changing.

We hope it becomes more convenient and user-friendly, and it may even be less serious.

Compared with traditional international-level regulators, the IMF has always been open to cryptocurrencies. In 2018, it released an article on cryptocurrency introduction on its official website ; even according to the British Financial Times (Financial Times) ) According to a report in April, the IMF and World Bank have jointly launched a private blockchain and a “quasi-cryptocurrency-Learning Coin”: Financial Times emphasized that the token has no monetary value and is therefore not a real cryptocurrency.

Bitcoin, encrypted currency (digital currency), and blockchain technology have been strongly banned by governments of various countries from the beginning. Now governments are vying to adopt blockchain technology to invent digital currencies in various countries, and their attitudes have changed 180°. As an investor, you must always pay attention to market fluctuations and trends.

Welcome to subscribe to our YouTube channel【Work Your Wealth Asia Passive Income Master 】

We have many financial investment educational videos, updated from time to time every week.

It’s time to grasp the pulse of this rapidly changing era, make the right choice at the critical moment, and get faster progress and a better life.

©All rights reserved.