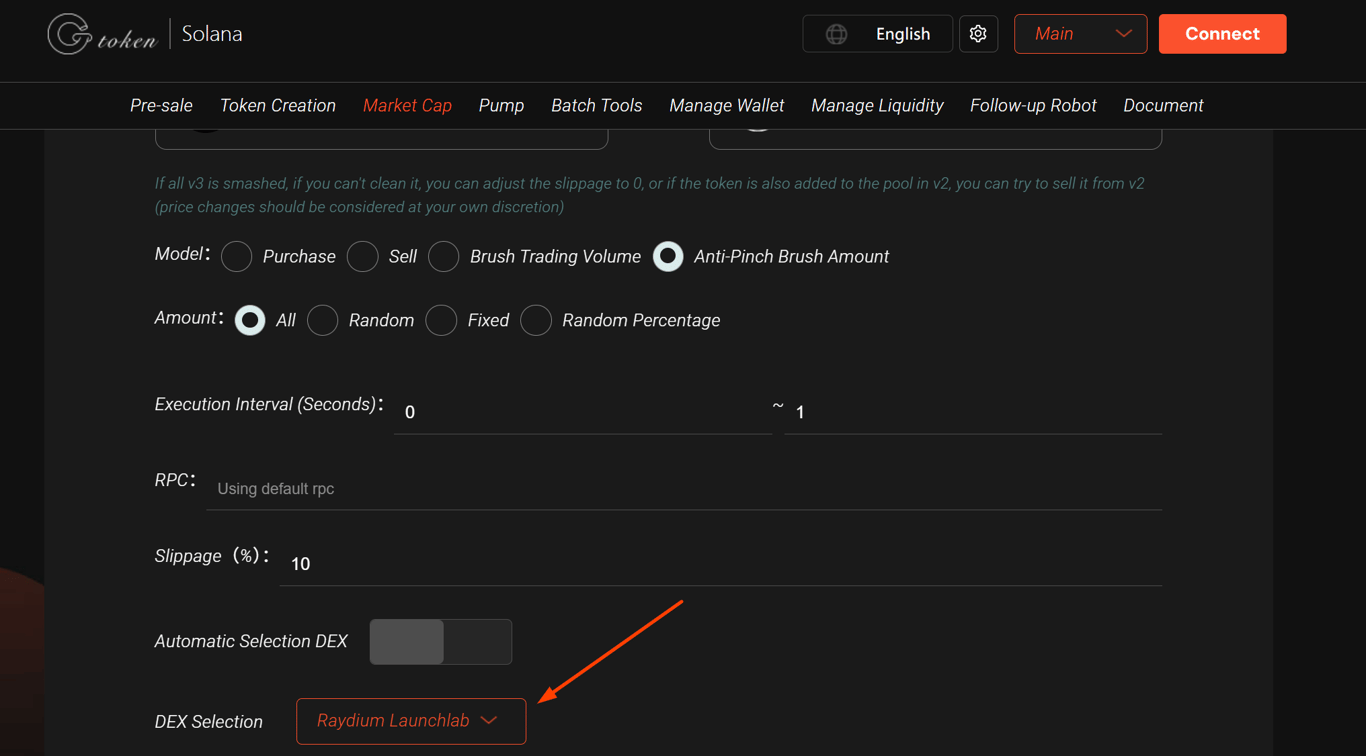

Raydium's LaunchLab: Anti pinch brush volume

What is Raydium LaunchLab?

Raydium, a leading decentralized exchange (DEX) on Solana, launched LaunchLab in April 2025 — a game-changing platform for token launches. Designed for developers and traders, it offers fully customizable token creation, positioning itself as a strong competitor to Pump.fun. By combining flexibility with Solana’s speed and low costs, LaunchLab is redefining how projects enter DeFi.

Using GTokenTool as a Trading Bot & Sniper

Traders can supercharge their LaunchLab experience with GTokenTool, a powerful trading bot and sniper tool. GTokenTool automates trades, snipes new token launches, and executes precision strategies to capitalize on price movements. By integrating GTokenTool, users can monitor LaunchLab’s dynamic bonding curves and optimize returns, making it essential for navigating Solana’s fast-paced DeFi market.

https://sol.gtokentool.com/market/jupMarket

Why Raydium Launched LaunchLab

The rise of Pump.fun, a user-friendly Solana token launchpad, was the catalyst. Pump.fun’s success threatened Raydium, which previously earned 41% of its swap fees from Pump.fun integrations. When Pump.fun announced plans to build its own AMM, Raydium responded with LaunchLab — a strategic move to retain control and attract new projects.

LaunchLab wasn’t a rushed reaction — it had been in development for months. Raydium initially held back to avoid direct competition, but shifting market dynamics accelerated its release, showcasing Raydium’s commitment to innovation.

Key Features of LaunchLab

LaunchLab stands out with powerful tools for both beginners and pros:

Dynamic Bonding Curves — Choose from linear, exponential, or logarithmic curves to fine-tune token pricing.

Custom Fees — Set tailored fee structures for better tokenomics.

Multi-Token Support — Launch with SOL or other quote tokens for more trading pairs.

Instant Raydium Liquidity — New tokens integrate seamlessly into Raydium’s liquidity pools.

User-Friendly Interface — Simple yet packed with advanced options.

Whether launching memecoins or DeFi projects, LaunchLab leverages Solana’s speed for seamless launches.

How LaunchLab Works

Creating a token is straightforward:

Enter the token name, ticker, and logo.

Configure the bonding curve and fees.

Launch — prices adjust in real time based on demand.

When liquidity is withdrawn:

20% of remaining tokens go to Raydium’s liquidity pools.

The rest are burned to maintain clean tokenomics.

LaunchLab also supports cross-chain transfers, making it easy for Ethereum or BNB Chain assets to enter Solana.

Market Reaction & RAY Token Surge

The announcement sent RAY soaring 28%, from 1.60toover1.60toover2, with trading volume hitting $250M (a 5x spike). Investors see LaunchLab as Raydium’s edge in Solana DeFi — though RAY remains below its all-time high, strong adoption could drive long-term growth.

Why LaunchLab Matters for Raydium

This isn’t just a new product — it’s a strategic shift. Raydium is evolving from a liquidity provider into a full DeFi hub. By offering advanced tokenomics, it aims to pull projects from Pump.fun and attract new builders, potentially sparking a platform war that benefits users with lower fees and more innovation.

Challenges Ahead

Competition — Pump.fun’s simplicity and user base won’t be easy to beat.

Trust — High-quality projects are key to avoiding memecoin volatility.

Adoption — Balancing advanced features with ease of use will decide mass appeal.

Raydium’s focus on customization and community governance could help — but execution is everything.

Growth Opportunities

Ecosystem Integration — LaunchLab’s link to Raydium’s liquidity is a major advantage.

Cross-Chain Reach — Attracting Ethereum/BNB Chain users expands Solana’s DeFi footprint.

First-Mover Wins — If top projects launch here, momentum could snowball.

The Future of LaunchLab

As adoption grows, LaunchLab could:

Solidify Raydium’s leadership in Solana DeFi.

Drive innovation through competition with Pump.fun.

Fuel the next wave of memecoins and DeFi projects.

Bottom Line

Raydium LaunchLab isn’t just another launchpad — it’s a bold leap forward for Solana DeFi. With deep customization, instant liquidity, and a clear vision, it has the tools to compete and win. Whether you’re a dev or a trader, LaunchLab is worth watching.

FAQs

1. What’s Raydium LaunchLab?

A Solana-based platform for launching tokens with customizable bonding curves and fees — directly competing with Pump.fun.

2. How is it different from Pump.fun?

More flexible curves, multi-token support, and deeper Raydium integration — while keeping it simple.

3. Are LaunchLab contracts verified?

No official addresses yet. Always check Raydium’s official channels.

4. Why did RAY pump after the announcement?

A 28% surge reflected investor confidence in Raydium’s ability to compete in DeFi.